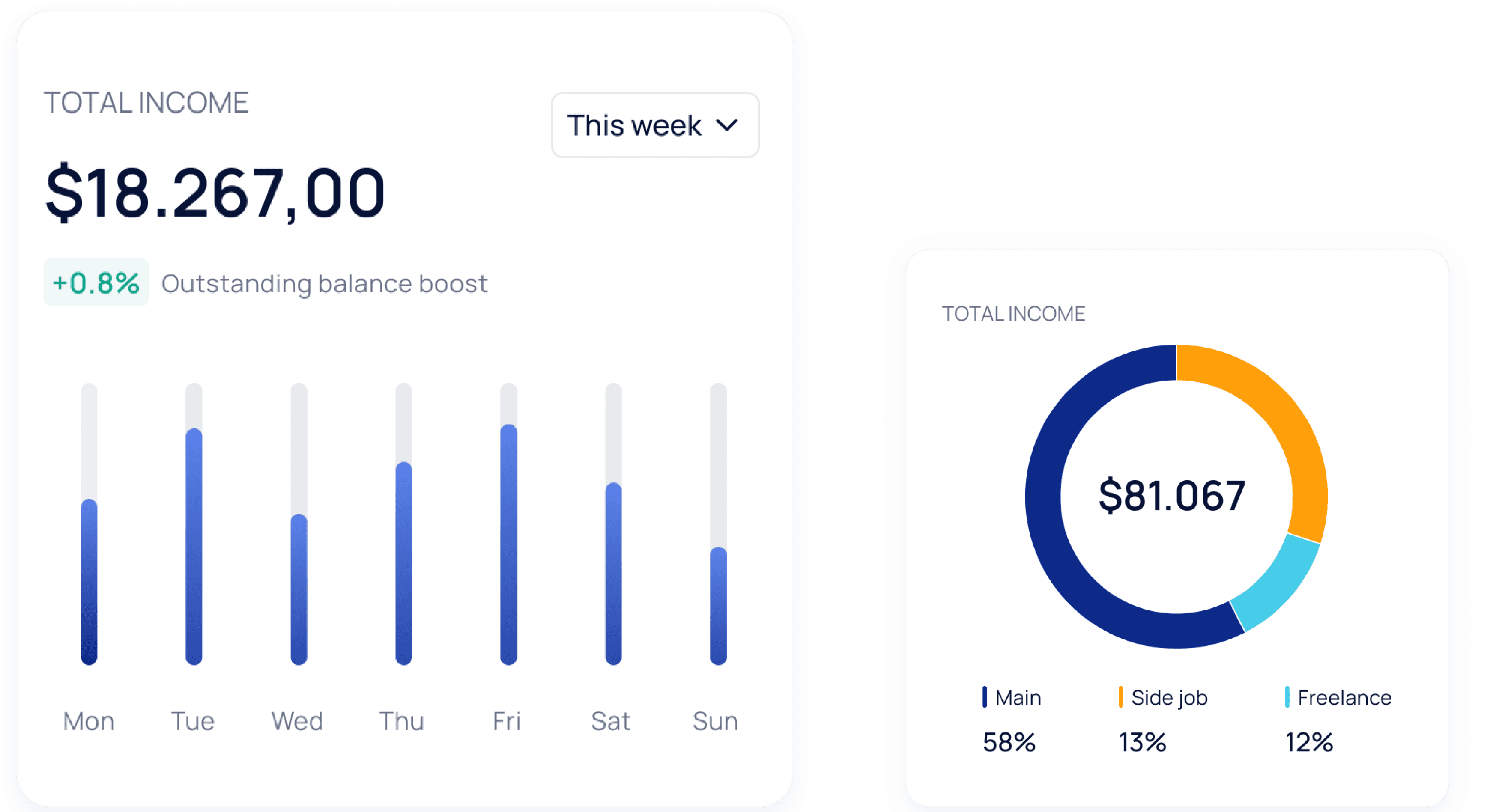

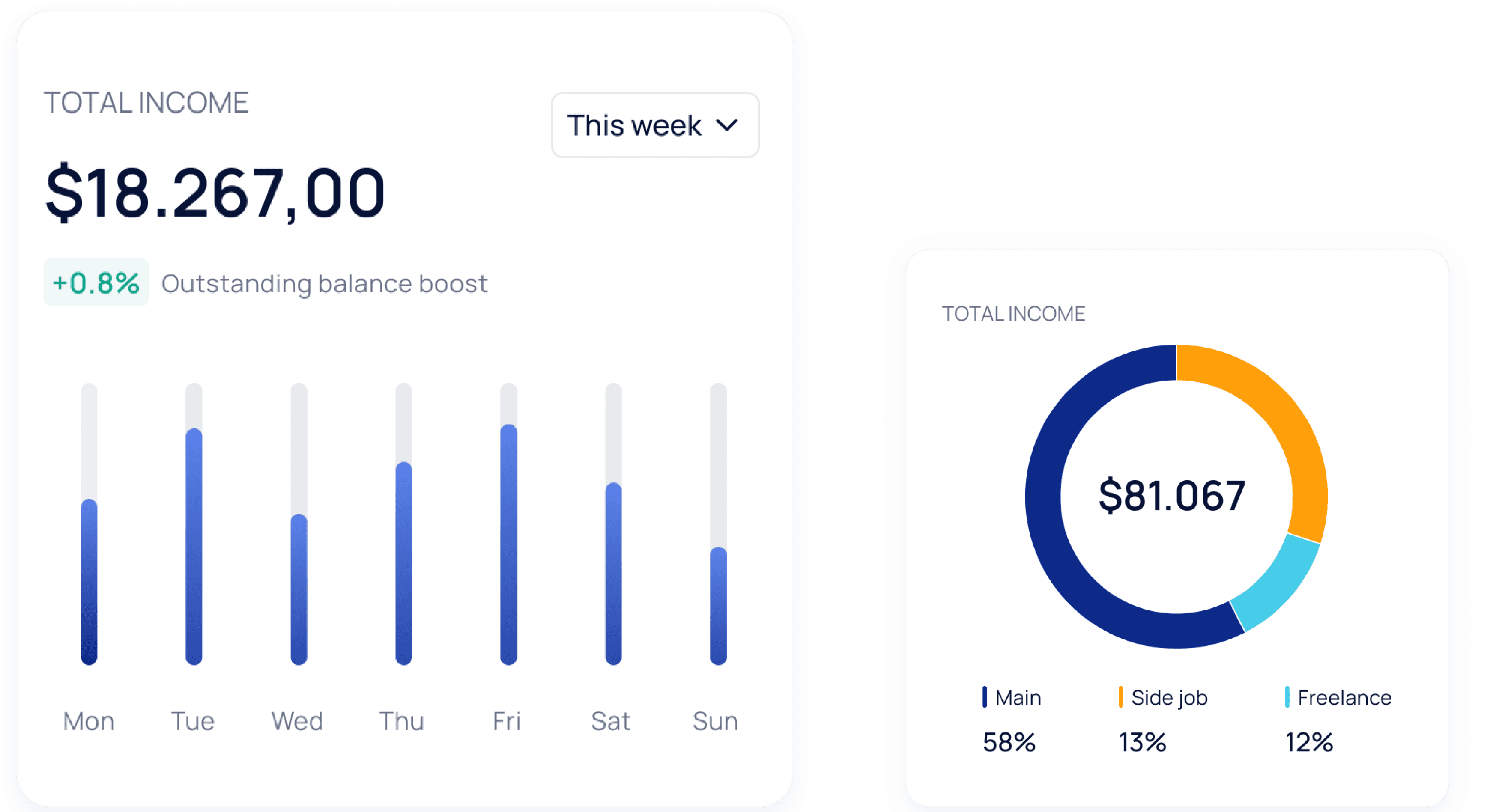

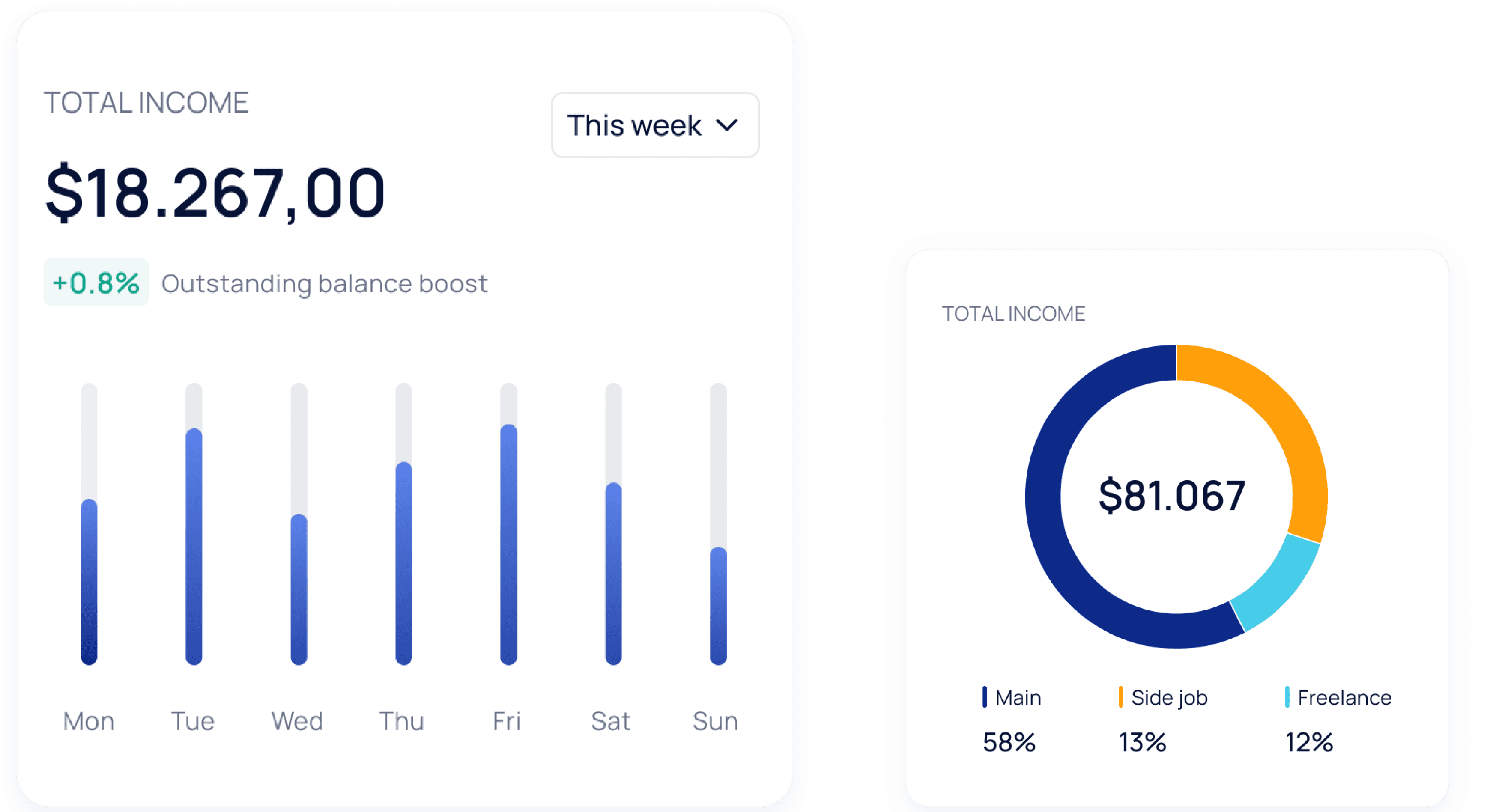

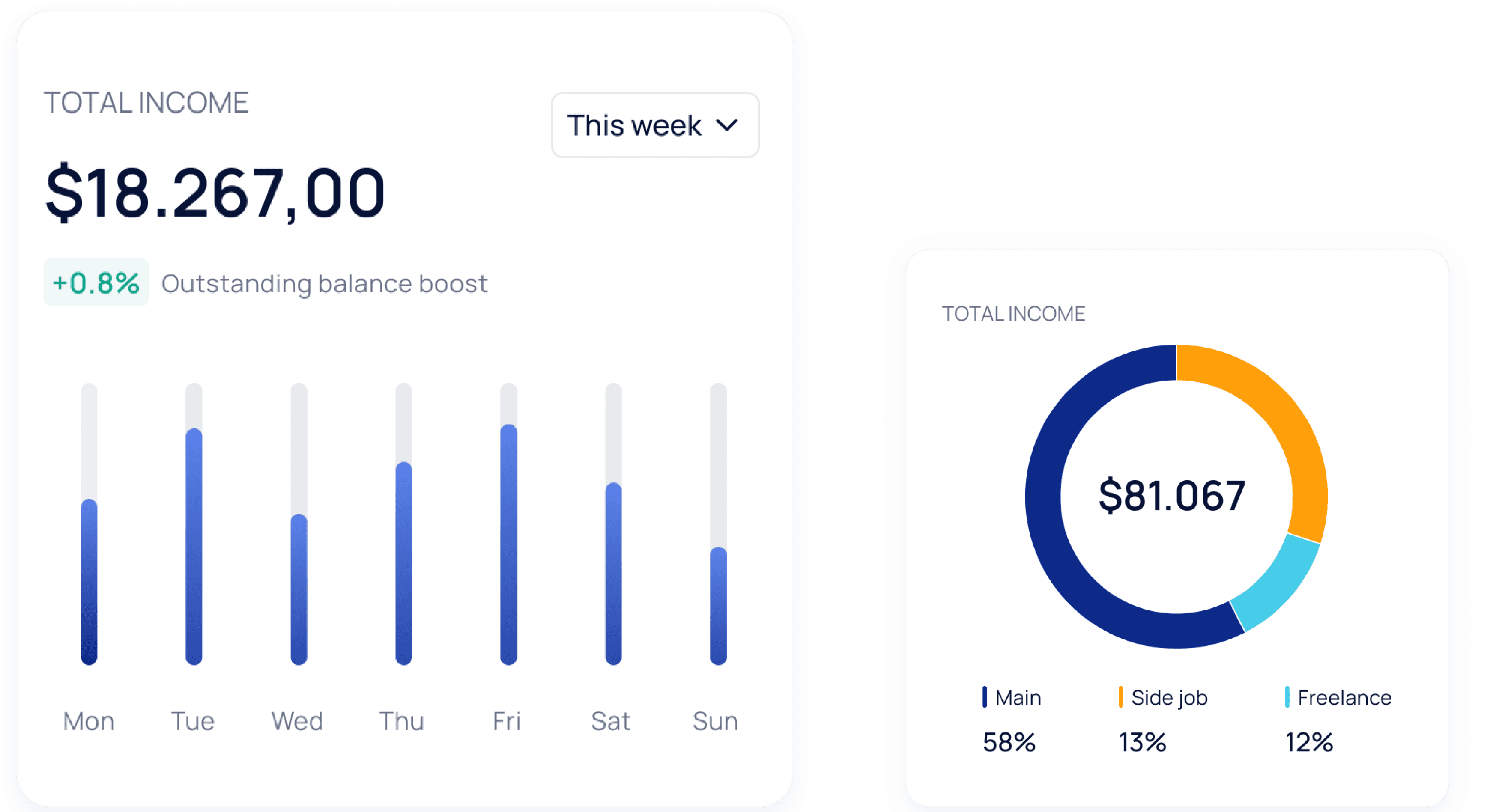

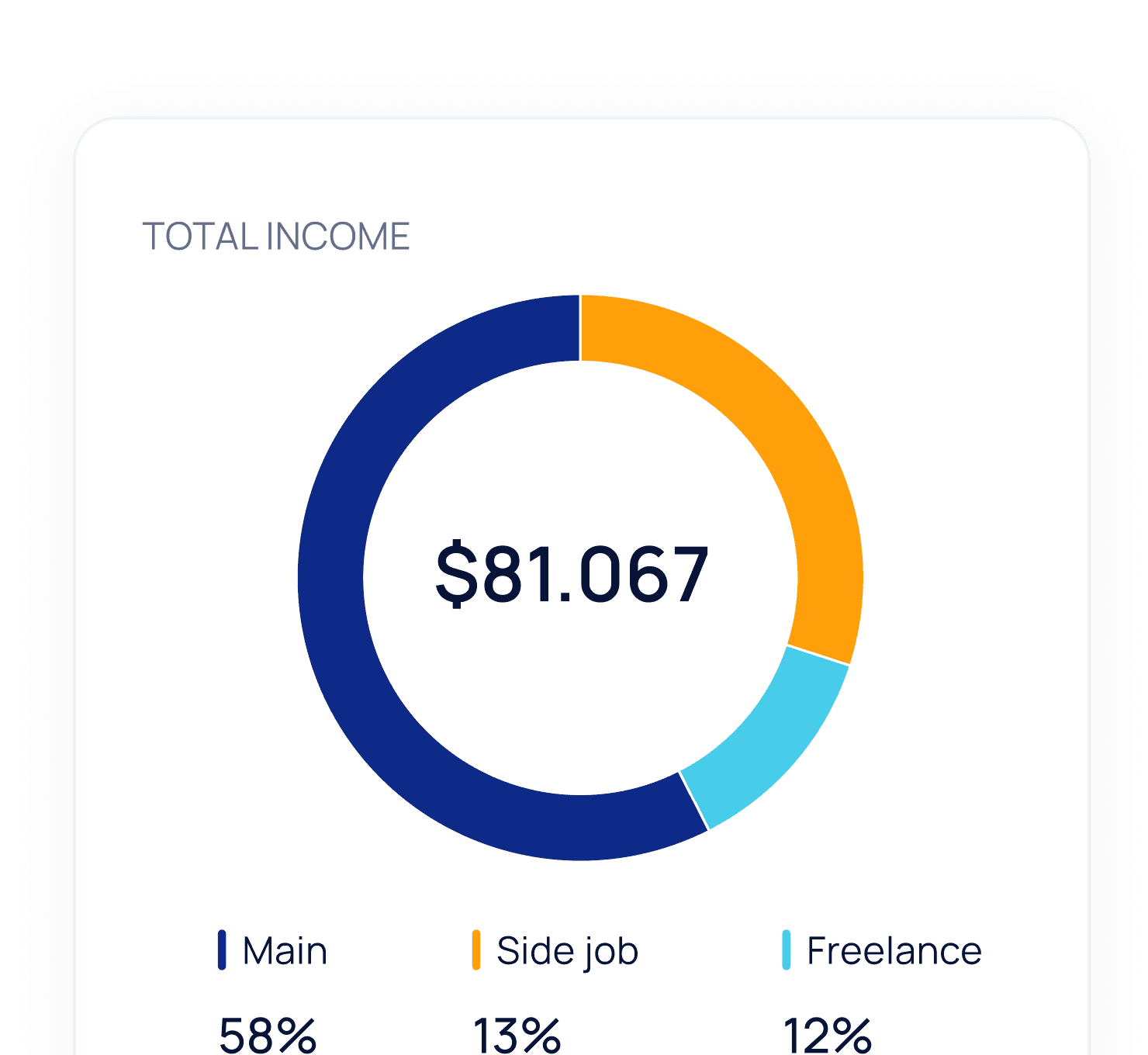

Reveal Financial Intelligence

Reveal Financial Intelligence

Reveal Financial Intelligence

Reveal Financial Intelligence

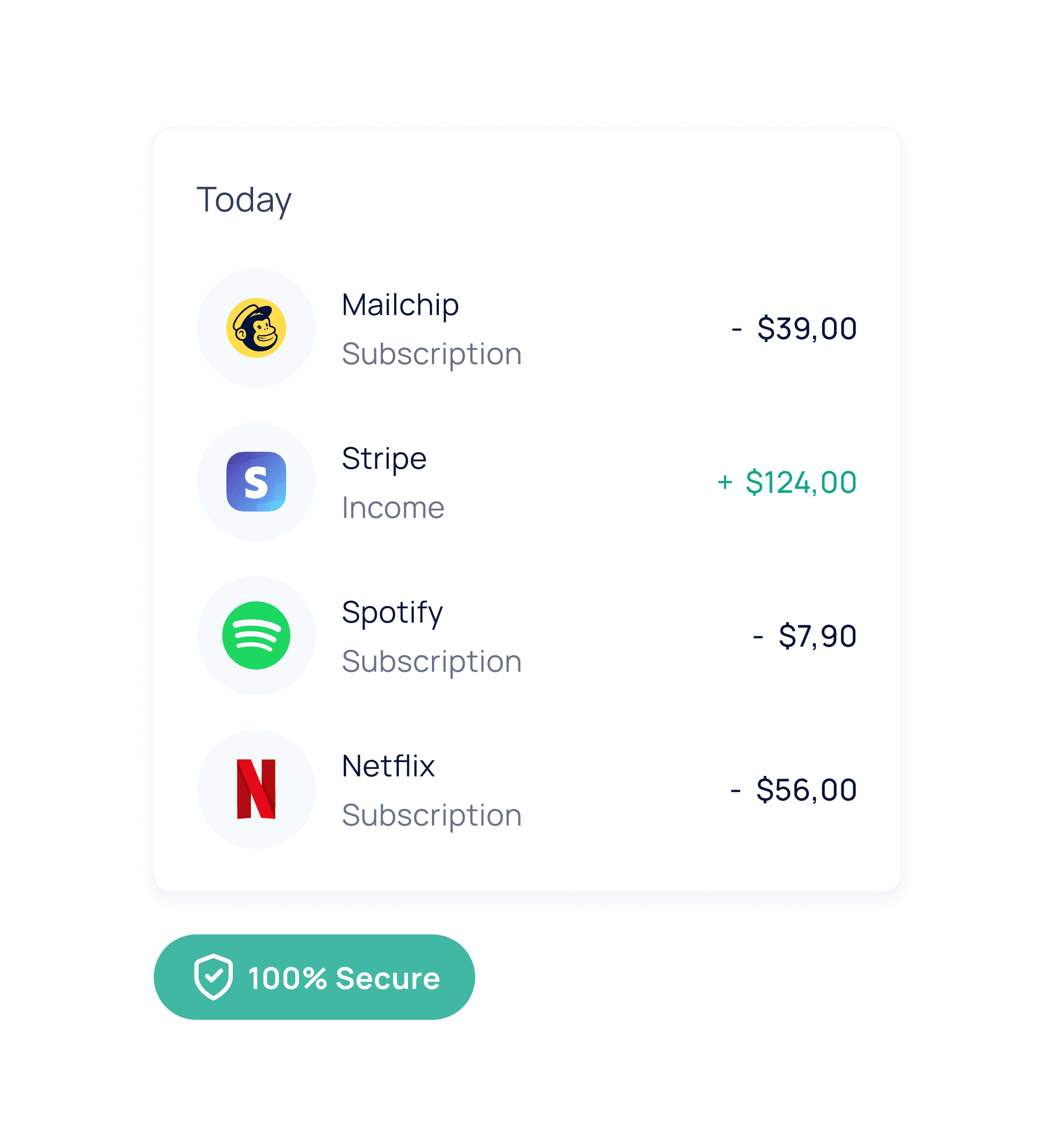

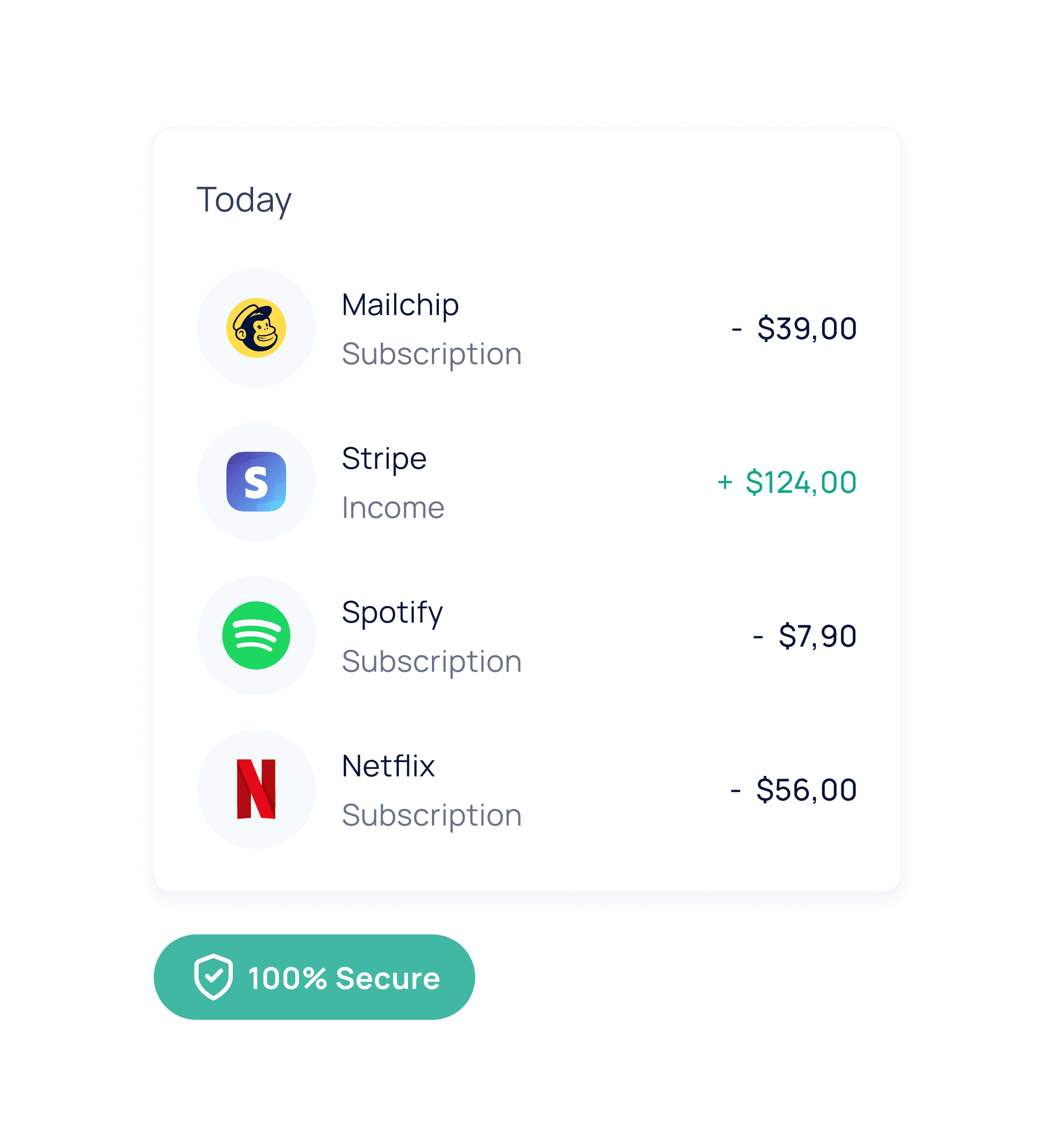

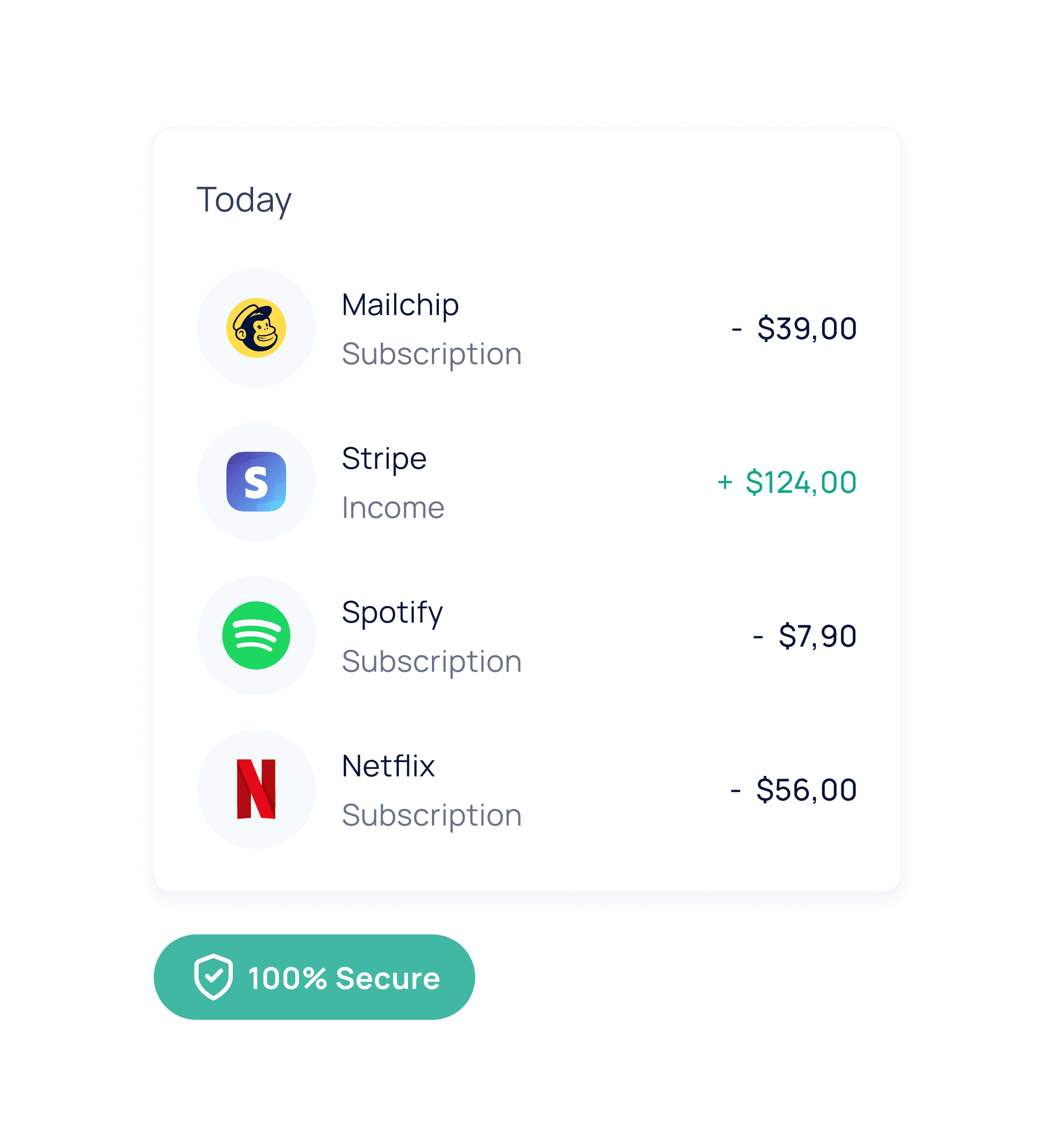

Simplify Spending easy cards, limits, and savings.

Simplify Spending easy cards, limits, and savings.

Simplify Spending easy cards, limits, and savings.

Simplify Spending easy cards, limits, and savings.

Providing financial solutions to help you achieve your goals. From personalized financial planning to seamless online transactions.

Providing financial solutions to help you achieve your goals. From personalized financial planning to seamless online transactions.

Providing financial solutions to help you achieve your goals. From personalized financial planning to seamless online transactions.

Providing financial solutions to help you achieve your goals. From personalized financial planning to seamless online transactions.

Trusted by over 250K+ users

Trusted by over 250K+ users

Trusted by over 250K+ users

Trusted by over 250K+ users

Revolutionary Apps

Elevate your digital experience with the latest in cutting-edge technology. Our commitment to innovation ensures you enjoy seamless.

Future-Ready Solutions

Embrace tomorrow's possibilities with us today. Explore a suite of services meticulously crafted to anticipate and meet the evolving demands of the future.

Continuous Advancement

Experience ongoing enhancements for an ever-evolving journey. Our dedication to continuous improvement means you can trust our solutions to adapt and grow.

Revolutionary Apps

Elevate your digital experience with the latest in cutting-edge technology. Our commitment to innovation ensures you enjoy seamless.

Future-Ready Solutions

Embrace tomorrow's possibilities with us today. Explore a suite of services meticulously crafted to anticipate and meet the evolving demands of the future.

Continuous Advancement

Experience ongoing enhancements for an ever-evolving journey. Our dedication to continuous improvement means you can trust our solutions to adapt and grow.

Revolutionary Apps

Elevate your digital experience with the latest in cutting-edge technology. Our commitment to innovation ensures you enjoy seamless.

Future-Ready Solutions

Embrace tomorrow's possibilities with us today. Explore a suite of services meticulously crafted to anticipate and meet the evolving demands of the future.

Continuous Advancement

Experience ongoing enhancements for an ever-evolving journey. Our dedication to continuous improvement means you can trust our solutions to adapt and grow.

DYNAMIC

DYNAMIC

Effortless Budgeting for Stress-Free Financial Management

Effortless Budgeting for Stress-Free Financial Management

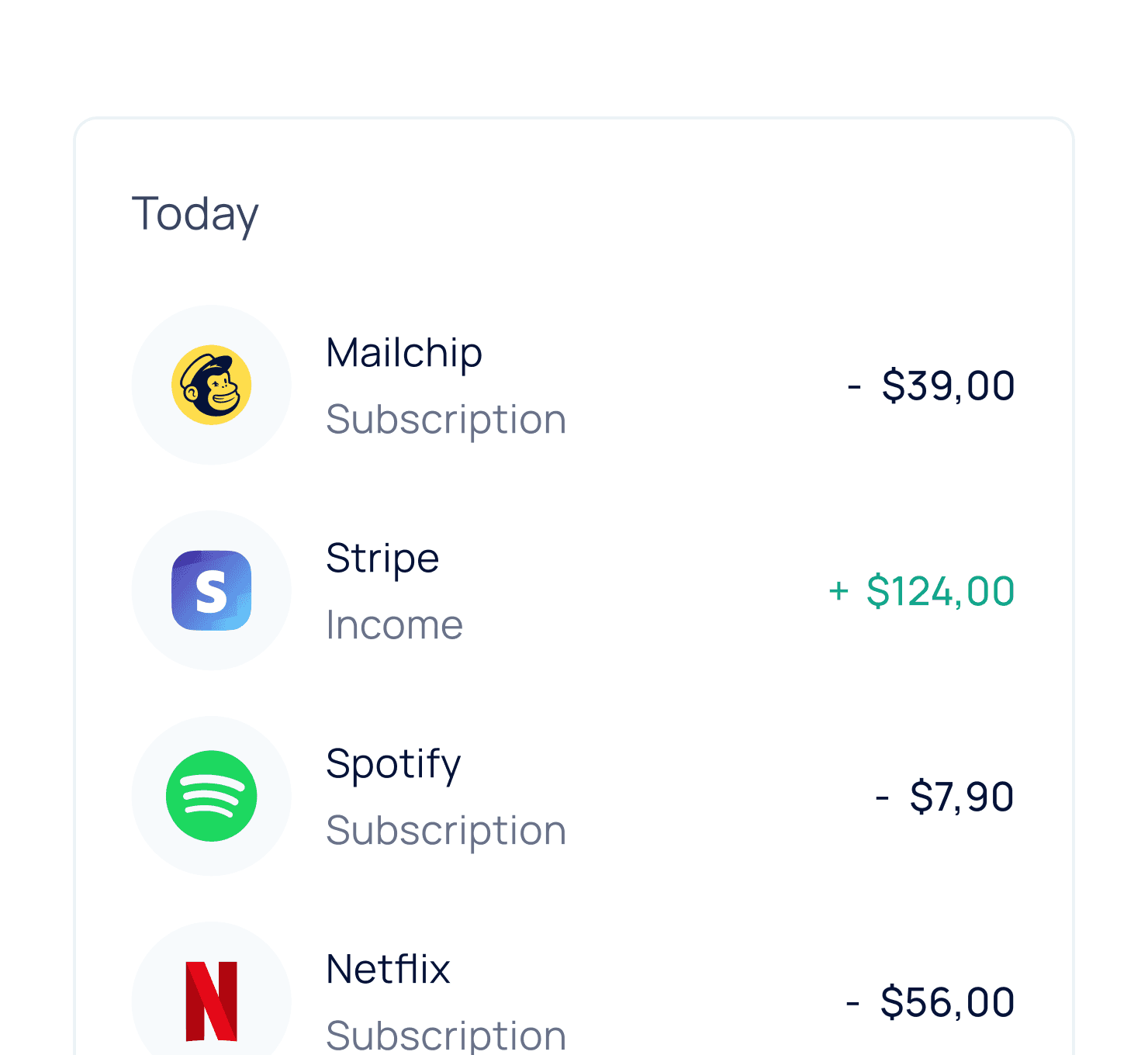

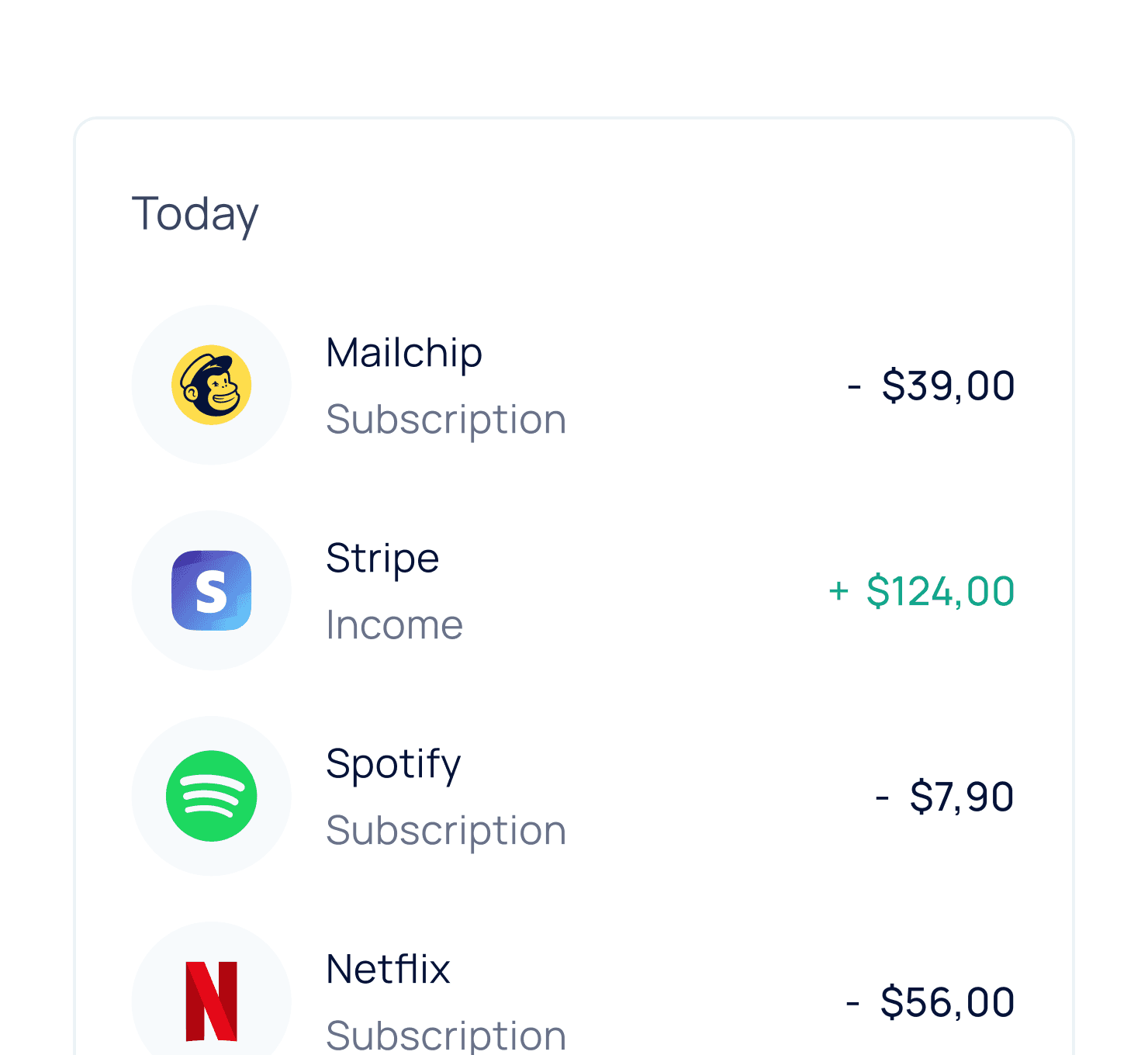

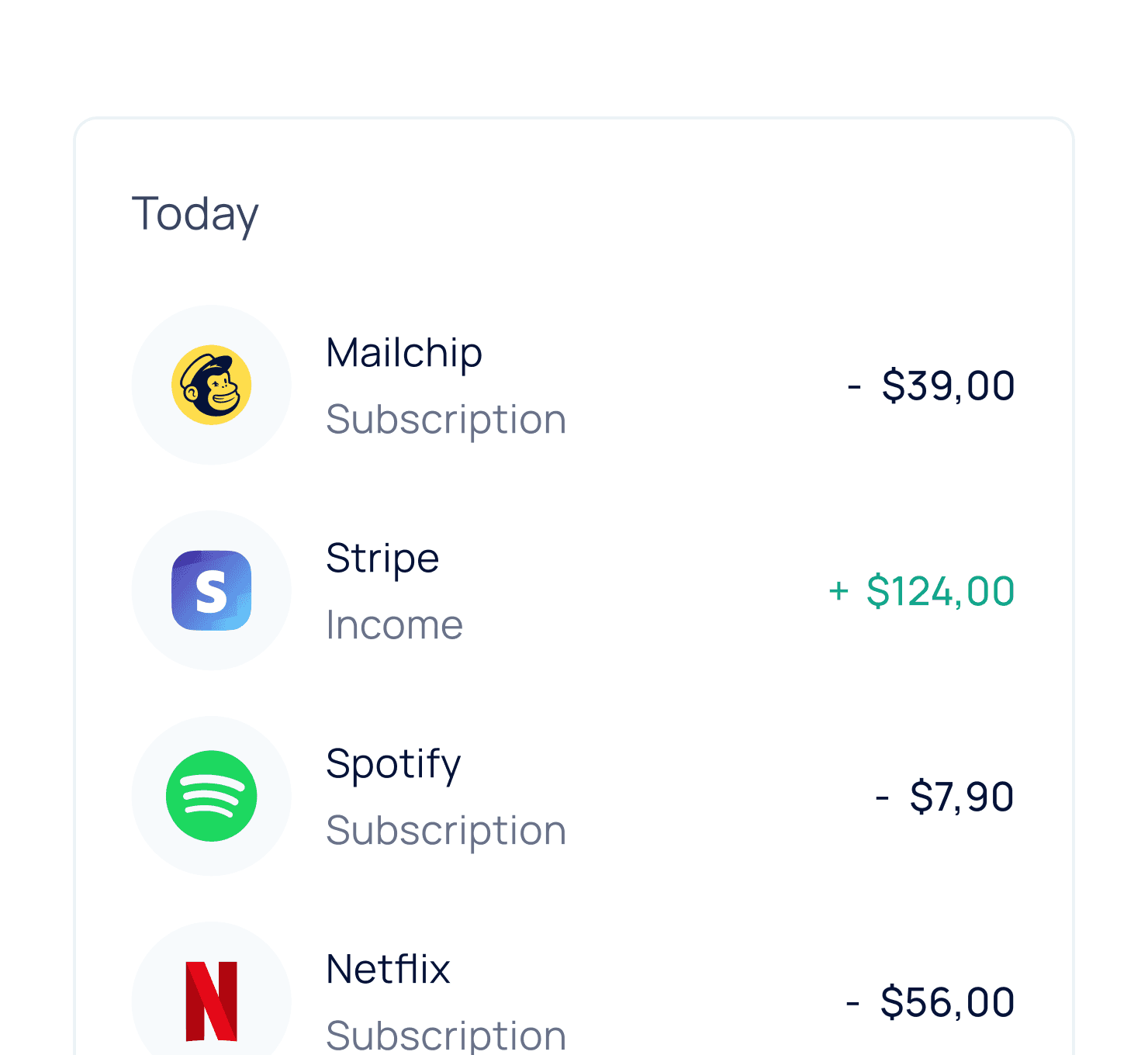

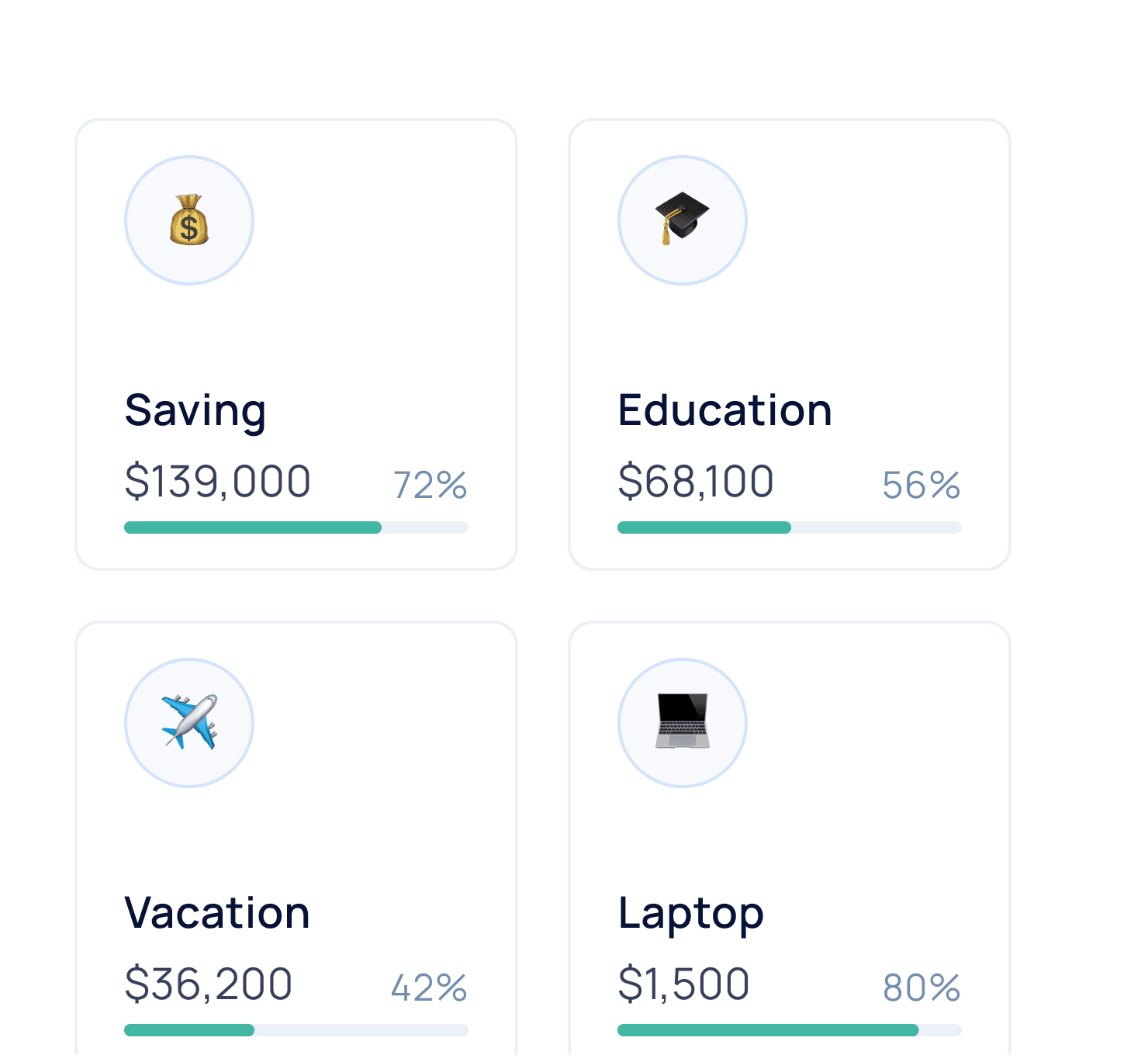

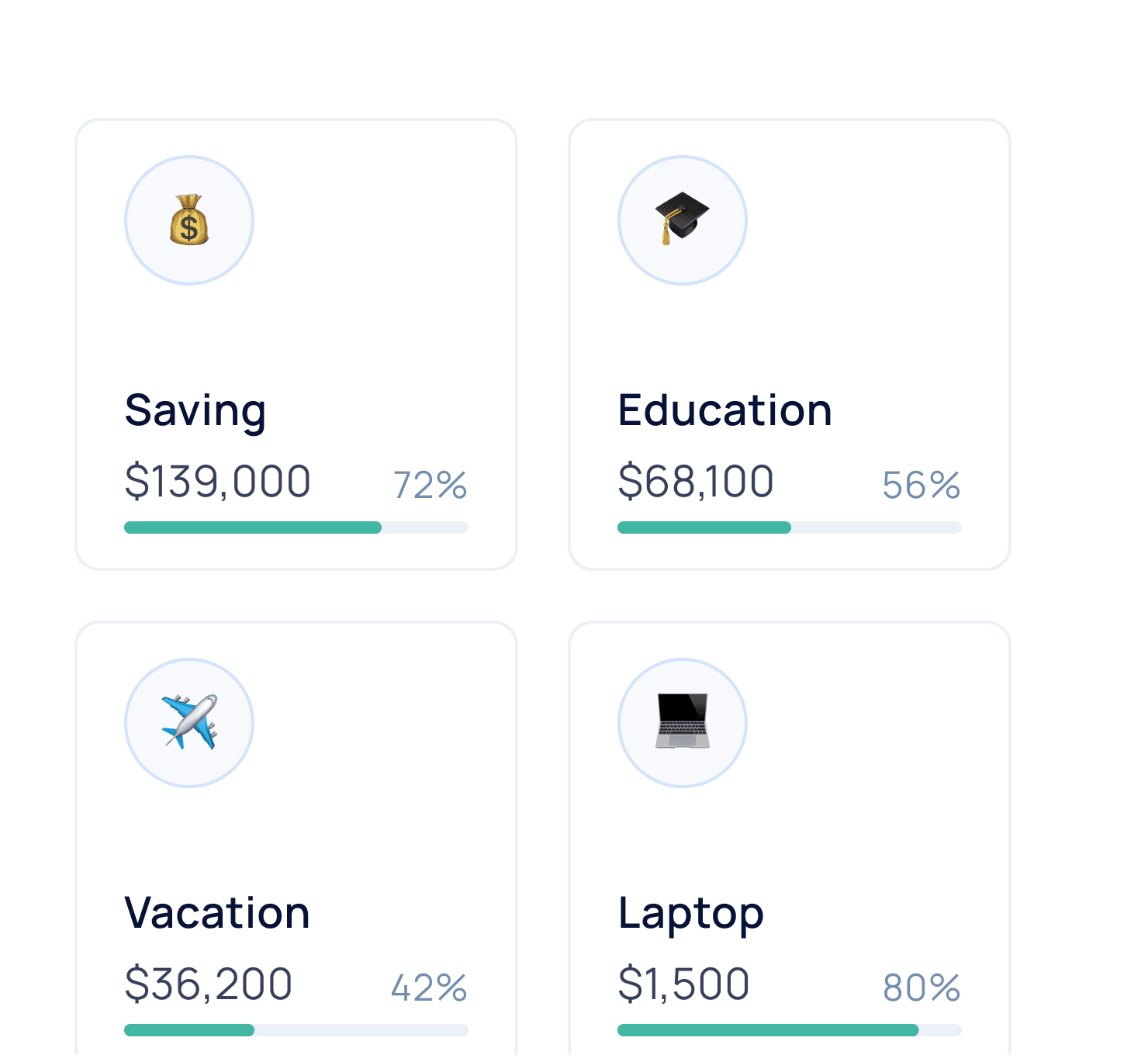

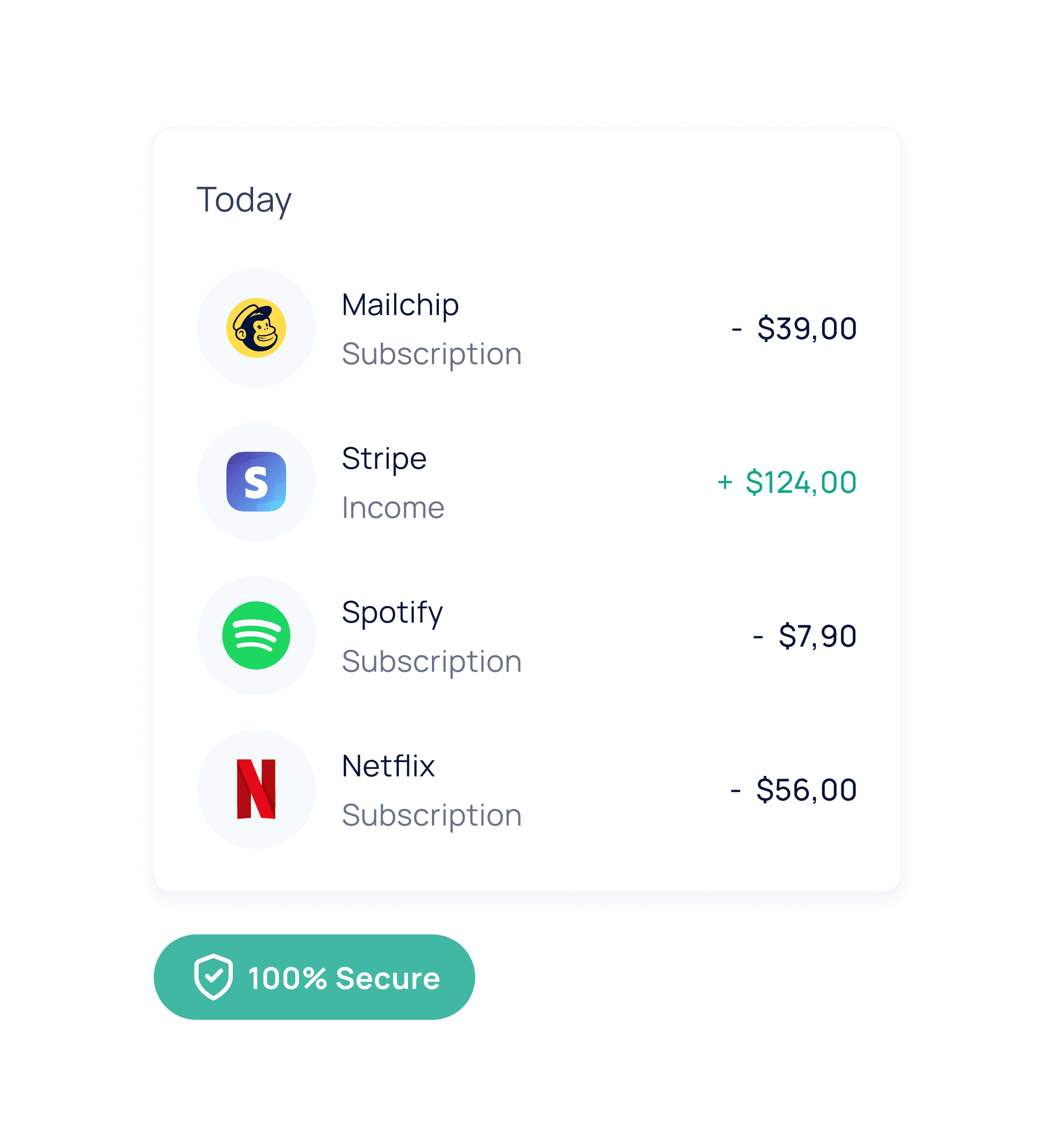

Tracker

Track your expenses for mindful consumptions

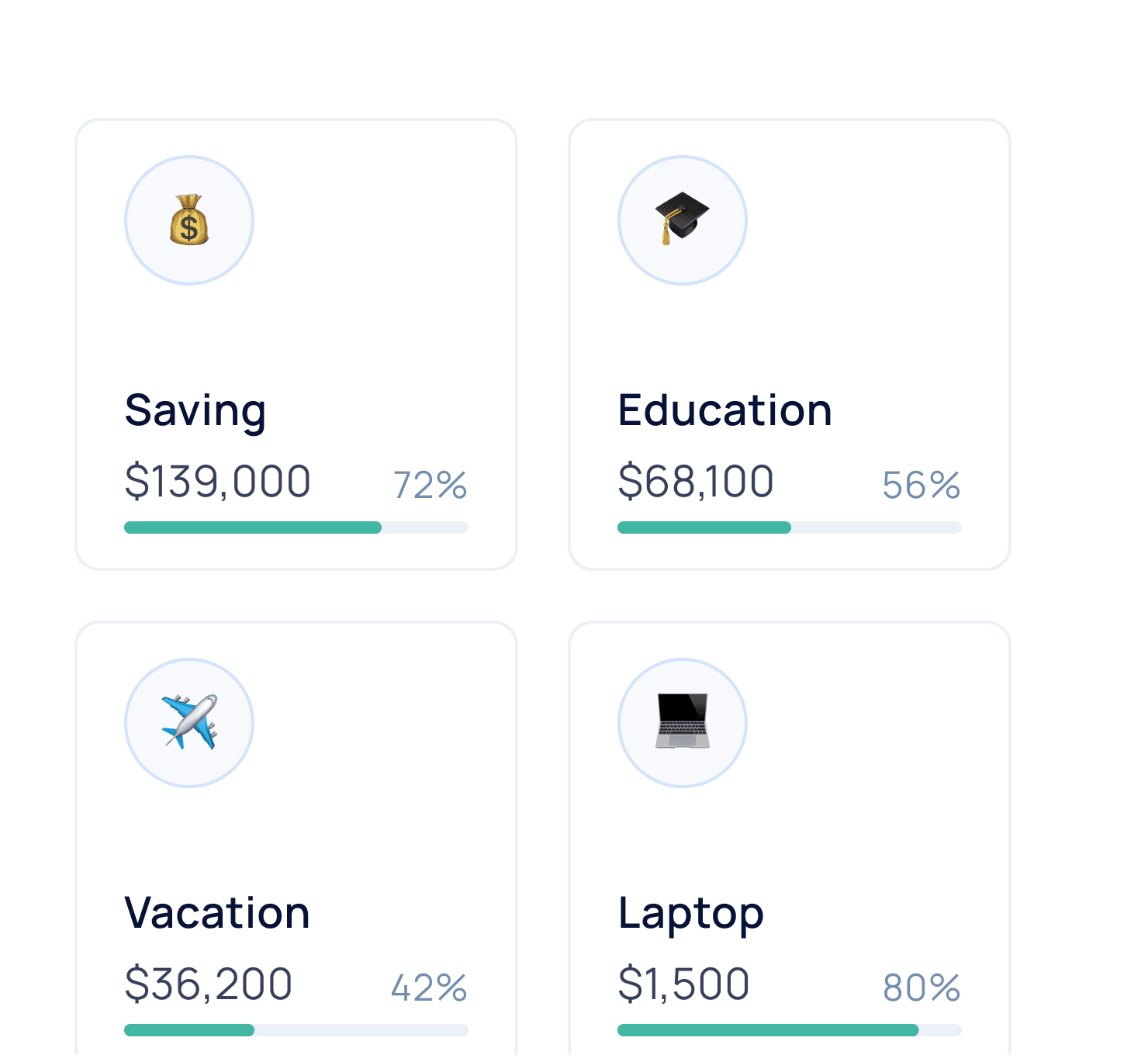

Saving

Create your own budgeting to manage your income

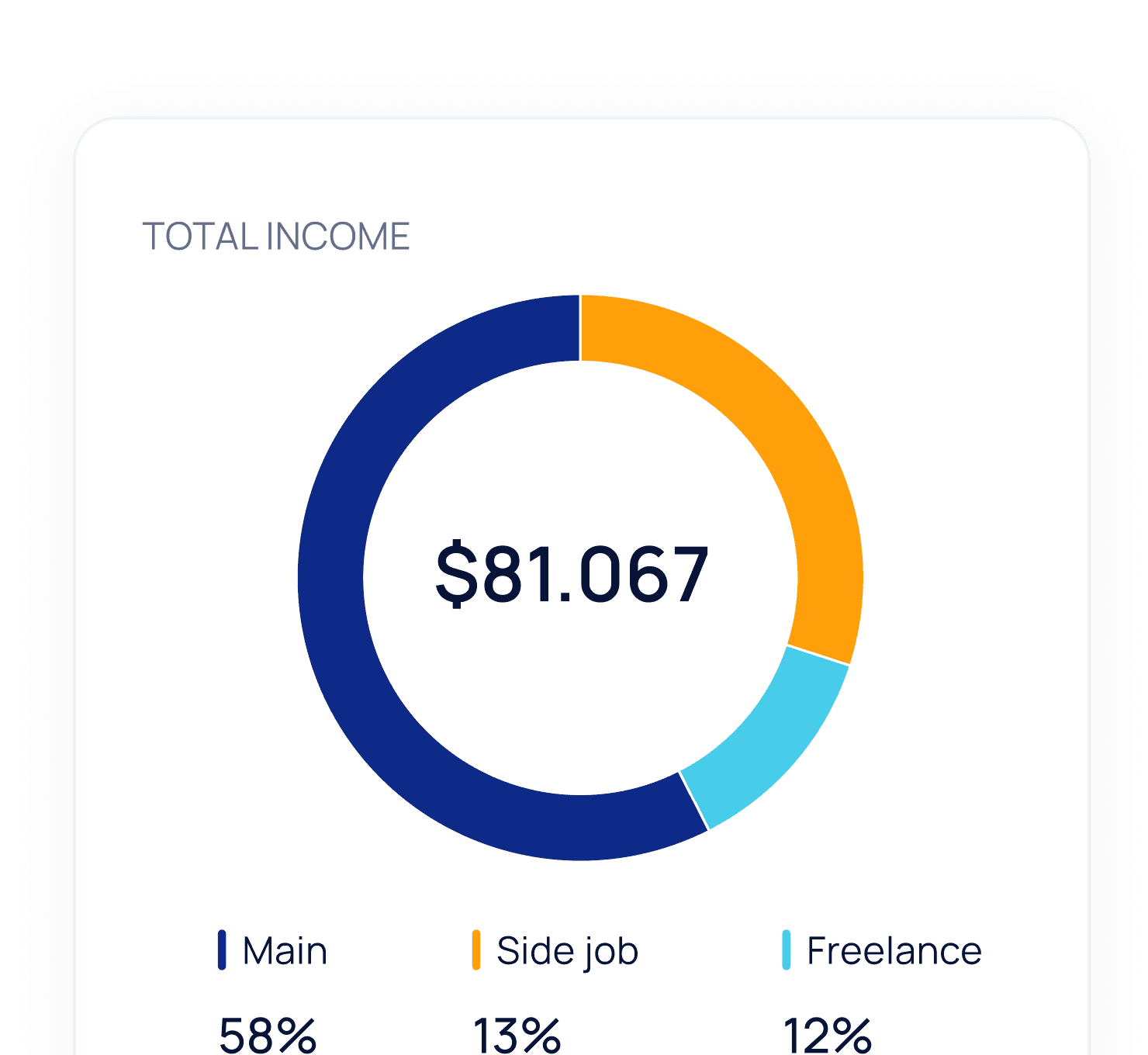

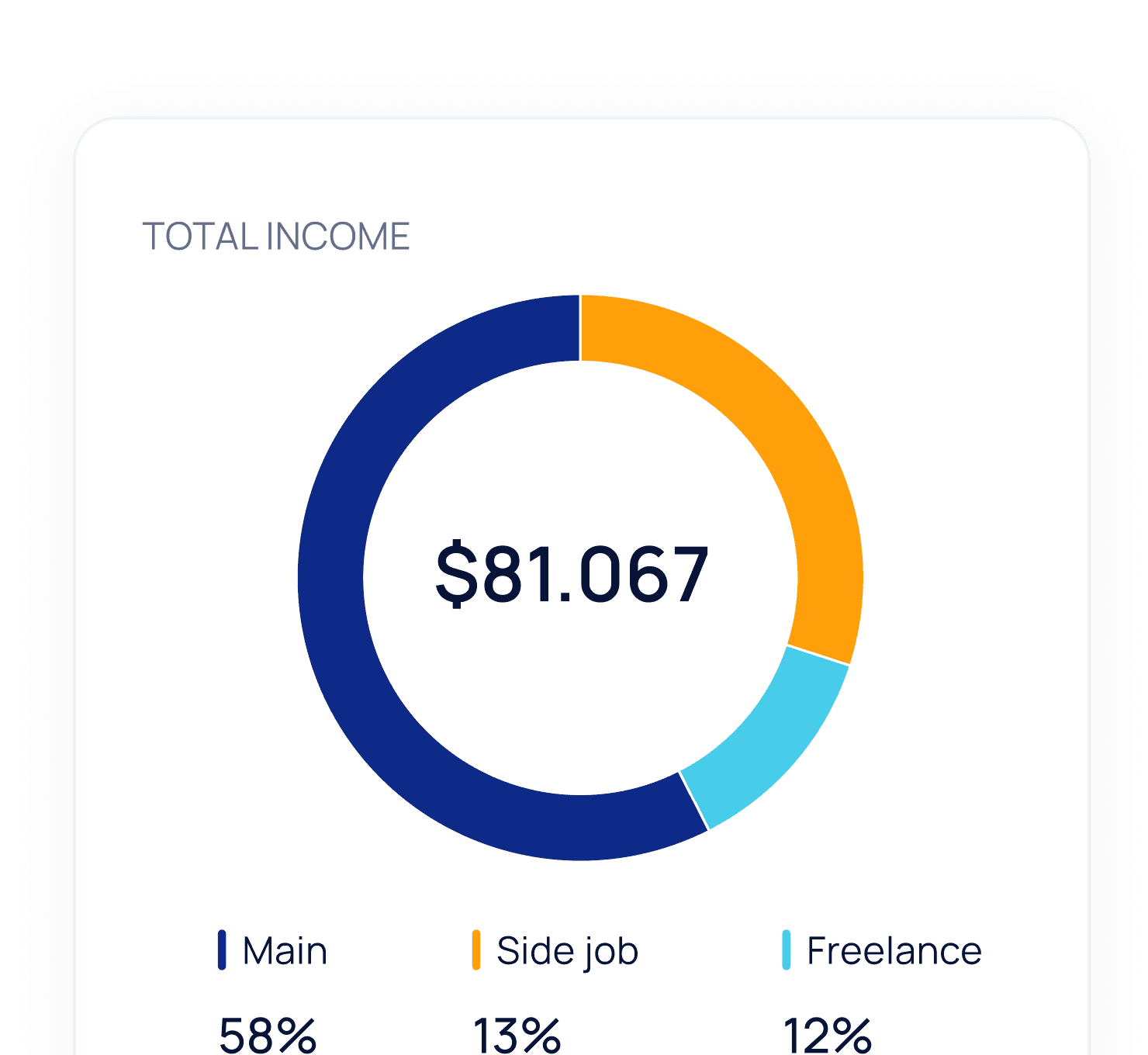

Chart

Perfect created chart to know where your money go

SECURE

SECURE

Crafted for Your Financial Security

Crafted for Your Financial Security

In an era where digital transactions shape the financial landscape, our commitment to your security is unwavering. Delight in the confidence of conducting transactions with our state-of-the-art security features, meticulously designed to safeguard your financial well-being.

In an era where digital transactions shape the financial landscape, our commitment to your security is unwavering. Delight in the confidence of conducting transactions with our state-of-the-art security features, meticulously designed to safeguard your financial well-being.

Cutting-Edge Encryption

Cutting-Edge Encryption

Continuous Vigilance

Continuous Vigilance

User-Centric Design

User-Centric Design

What Our Clients Say

What Our Clients Say

Discover why over 4,000 clients trust Finet for their financial journey.

Discover why over 4,000 clients trust Finet for their financial journey.

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

John D

Happy customer

“Finet has been instrumental in helping me plan for my retirement. Their expert financial advisors provided personalized guidance, and I feel confident about my financial future.”

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

John D

Happy customer

“Finet has been instrumental in helping me plan for my retirement. Their expert financial advisors provided personalized guidance, and I feel confident about my financial future.”

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

John D

Happy customer

“Finet has been instrumental in helping me plan for my retirement. Their expert financial advisors provided personalized guidance, and I feel confident about my financial future.”

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

John D

Happy customer

“Finet has been instrumental in helping me plan for my retirement. Their expert financial advisors provided personalized guidance, and I feel confident about my financial future.”

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

John D

Happy customer

“Finet has been instrumental in helping me plan for my retirement. Their expert financial advisors provided personalized guidance, and I feel confident about my financial future.”

Emma Watson

Happy customer

“Their personalized financial planning and state-of-the-art security features have transformed the way we approach our finances. A trusted ally for a secure and prosperous future.”

OUR BLOGS

OUR BLOGS

Invest. Thrive. Learn.

Invest. Thrive. Learn.

Unlock Financial Success: Explore investment insights, thriving strategies, and continuous learning in our blog.

Financial

Dive into the world of effective budgeting with this insightful guide, offering practical tips and strategies to help you take control of your finances. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Dive into the world of effective budgeting with this insightful guide, offering practical tips and strategies to help you take control of your finances. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Taxes

Unravel the mysteries of investing with our beginner-friendly handbook, providing essential knowledge and actionable steps for those looking to start journey. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Unravel the mysteries of investing with our beginner-friendly handbook, providing essential knowledge and actionable steps for those looking to start journey. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Investment

In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Financial

Dive into the world of effective budgeting with this insightful guide, offering practical tips and strategies to help you take control of your finances. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Taxes

Unravel the mysteries of investing with our beginner-friendly handbook, providing essential knowledge and actionable steps for those looking to start journey. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Financial

Dive into the world of effective budgeting with this insightful guide, offering practical tips and strategies to help you take control of your finances. In this exploration, we demystify the intricacies of budgeting, a vital skill on the path to enduring financial freedom. Begin by understanding the fundamentals, distinguishing between income and expenses, and appreciating the significance of meticulous expense tracking. Setting realistic financial goals becomes the next step, as we guide you through defining and prioritizing objectives, whether it's building an emergency fund, saving for a dream vacation, or securing a down payment.

Navigate the budgeting landscape with tailored techniques, from the versatile 50/30/20 rule to the meticulous approach of zero-based budgeting. We provide step-by-step instructions to assist in crafting a budget that harmonizes with your unique financial aspirations. Emphasizing the role of ongoing tracking and adjustment, we illustrate the adaptability required to accommodate life's changing circumstances.

Explore the concept of building a robust financial safety net through the establishment of an emergency fund, designed to navigate unforeseen financial challenges. Delve into the essence of financial discipline, discovering how to strike a balance between fiscal responsibility and enjoying life's pleasures without compromise.

Our guide also sheds light on the modern intersection of technology and budgeting, showcasing the benefits of finance apps and automated tracking tools in streamlining the budgeting process. Along the way, celebrate milestones achieved through your budgeting endeavors, whether it's paying off debt, reaching savings goals, or mastering new budgeting techniques.

Embodied within this journey is not just the creation of a comprehensive budget but also the cultivation of knowledge and confidence to steer your financial future. By the end of this guide, you'll be equipped to not only navigate the intricacies of budgeting but also to wield it as a powerful tool in sculpting a path towards enduring financial freedom and success.

Ready to Take Control

of Your Finances?

Experience banking so smooth it becomes invisible. Let us simplify your financial journey. Contact Finet for a frictionless future.

Ready to Take Control of Your Finances?

Experience banking so smooth it becomes invisible. Let us simplify your financial journey. Contact Finet for a frictionless future.

Ready to Take Control of Your Finances?

Experience banking so smooth it becomes invisible. Let us simplify your financial journey. Contact Finet for a frictionless future.